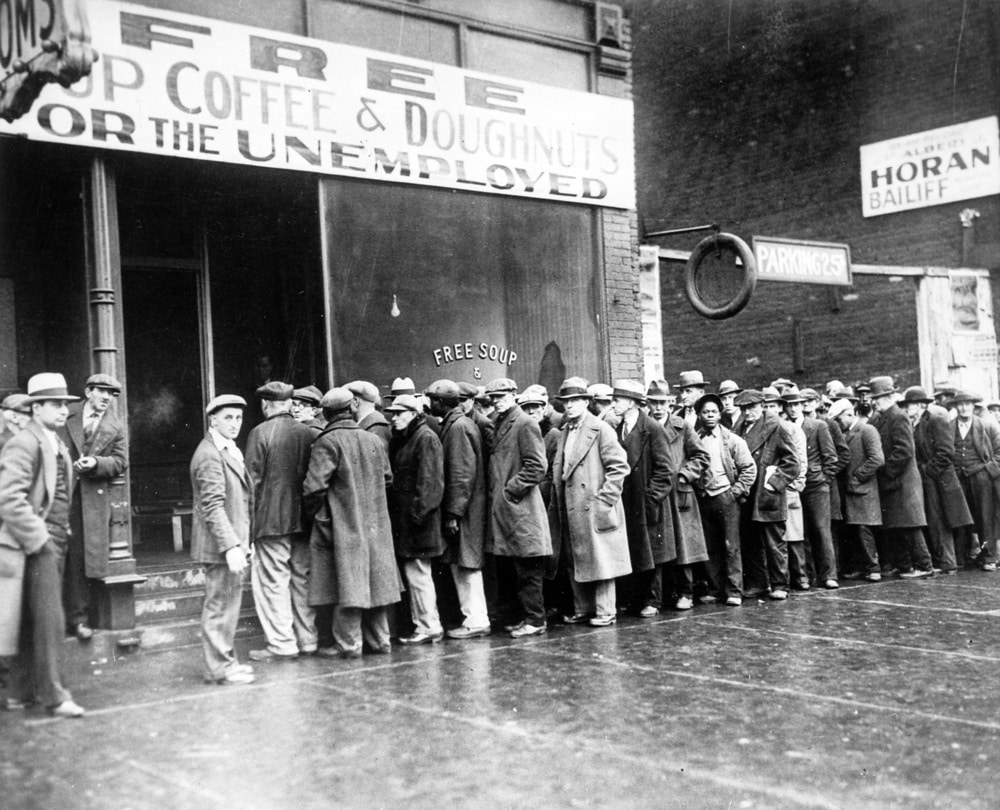

The unemployed wait in line at a Chicago soup kitchen during the Great Depression in 1931

The 2022 Nobel Prize in Economics has been awarded to three experts for their research on banking in financial crises: Americans Ben S. Bernanke (now a member of the Brookings Institution) and Douglas W. Diamond (University of Chicago), and Philip H. Dybvig (Washington University in St. Louis). One of the awardees, Bernanke, was tasked in 2008 with navigating the biggest economic crisis since 1929. His recognition is precisely for the role he played at the helm of the United States Federal Reserve during the Great Recession, triggered by subprime mortgages, which put the world´s financial system in check.

The researchers’ thesis is that banks play a transcendental role in crises and can exacerbate them or contribute to their resolve depending on how their work is managed by public institutions. In the words of the Swedish Academy, for example, Bernanke “showed how bank runs were a decisive factor in the crisis [of 1929] becoming so deep and prolonged.”

The starting point of the three researchers is that banks –financial institutions– are not neutral intermediaries between borrowers –individuals and companies– and lenders –those who have the money to invest–, because they offer vital information for the correct functioning of the economy. In particular, they collect information on borrowers and decide who to grant credit to, while channeling society’s savings. As The Economist wrote, “From this insight flows an important conclusion: because banks are crucial to the economy, they are also dangerous.”

Lessons from the Great Depression

In a famous 1983 paper, Bernanke “demonstrated, using statistical analysis and historical sources, that bank panic led to their bankruptcy and that this was the mechanism that turned a relatively ordinary recession into the depression of the 1930s, the most dramatic and severe financial crisis the world has even seen in modern history,” according to John Hassler, a member of the committee for the Nobel Prize in Economic Sciences. According to Bernanke, the bank panic was the main cause of the 1929 Great Depression. The overwhelming fear of savers of losing the money they had deposited in these entities caused a massive withdrawal of funds, credit rationing and a rise in interest rates that slowed down business activity. With the credit crisis, the economy ended up in a deep recession.

Ben Bernanke, an expert in the study of financial crises, was charged with leading the United States Federal Reserve through the second largest banking crisis of the 20th century, the one with origins in the United States stemming from an outbreak of the so-called “subprime mortgages” or “junk mortgages” –which had toxic assets that the banks were not going to be able to collect–, which materialized in September of 2008 with the bankruptcy of the investment bank Lehman Brothers.

As soon as credit granting began to slow, which endangered the entire country´s financial system, Bernanke activated a monetary stimuli system that consisted in injecting liquidity into the economy to prevent its collapse. Thus, he bought state bonds and mortgage assets in order to place that money in the productive system so that companies could have access to cheap lines of credit to continue investing and individuals would have money to continue spending. It was known as Bernanke’s “helicopter money,” in an image that reflected the distribution of millions and millions of dollars by throwing bills from the sky. At the same time, he left interest rates at zero in an additional effort to boost credit.

It was an expansive and heterodox economic policy – it had never been applied with such forcefulness in times of peace – but it was well regarded by economists at the time. It´s worth remembering Mario Draghi´s “we will do whatever it takes” statement on July 26, 2012, with which he put an end to speculations about the future of the euro derived from effects of the financial crisis in the European Union. To save the banks, Bernanke flouted liberal “orthodoxy,” but managed to get the economy back on track in a decent amount of time. Although it meant allocating trillions of dollars to stimulate the economy.

Avoid panic

Professors Diamond and Dybvig were also awarded this year’s Nobel Prize in Economic Studies for their study on the role of banks in crises. “They have developed theoretical models that explain why banks exist, how their role in society makes them vulnerable to rumors about their imminent collapse and how society can reduce this vulnerability,” the committee explained. In the first place, the members of the jury highlight their contributions on the importance of creating a deposit guarantee fund insured by the State in the face of crises. In other words, when rumors spread that a bank is in trouble, depositors rush to withdraw their savings, accelerating the institution´s collapse. On the other hand, if citizens know that their savings are safe because they are insured by the State, they are less likely to panic.

This year’s Nobel Prize recipient shows that rescuing banks with public resources in times of crisis is to safeguard savers, companies and the economy of a country

Diamond has also studied how banks play a role of social responsibility because part of their work is to examine credit applications and “they are better prepared to assess the creditworthiness of borrowers and ensure that loans are used for good investments,” the Nobel committee explained. Banks are fundamental, as they are the channels which enable money to reach the productive economy, which generates wealth and employment.

The Nobel Prize winners’ contribution rests is the light they shed on how ensuring the proper functioning of banks is essential to getting out of financial crises. Even if these institutions have contributed to triggering a crisis, they are critical to getting economies back on the path of growth and job creation. The restructuring of the banks was the first step to rebuilding what the crisis had destroyed. Prior to uncovering, as occurred in Spain with some savings banks, the allegedly criminal behavior of some of their managers which led to criminal proceedings and convictions. Or deeming whether the “bailouts” were done more or less successfully.

Some blame Bernanke for the sharp increase in prices in recent years, claiming his monetary stimulus policy was too aggressive. But what almost no one puts into question is that his actions, informed by his study of the Great Depression, were key in mitigating the negative effects of the 2008 crisis.

In short, this year’s Nobel Prizes in Economic Sciences remind us that saving financial institutions with public resources in times of crisis is not merely throwing a life raft to the big capitalists with the people’s money; rather, it safeguards savers, companies and the economy of a country.